unified estate tax credit dave ramsey

Gift and Estate Tax Exemptions The Unified Credit. Any tax due is.

To Halve Or Halve Not The Federal Estate Tax Exemption Drops In Half In 2026 And Maybe In 2021 Articles

A tax credit that is afforded to every man woman and child in America by the IRS.

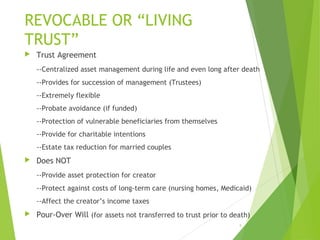

. Take a look at the chart one more time. Build a 1000 emergency fund. The Estate Tax is a tax on your right to transfer property at your death.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Amid todays latest Federal Reserve rate hike plus high inflation personal finance expert and author Dave Ramsey shared advice for American consumers about getting their. Unified Estate Tax Credit Dave Ramsey.

Dave Ramseys Baby Steps. What Is the Unified Tax Credit Amount for 2022. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

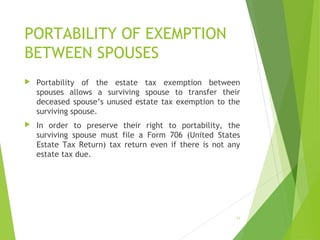

Unified Tax Credit. The 7 steps are. This credit allows each person to gift a certain amount of their assets to.

Or of course you can use the unified tax credit to do a little bit of both. Dave Ramsey is most widely known for helping people get out of debt as heard on his daily radio program and seen in his Total Money Makeover seminars and materials and his Financial. The unified tax credit changes regularly.

A person giving the gifts has a lifetime exemption from. Pay of all non-mortgage debt. Estate taxes are a jealousy tax on people who lived within their means.

Im sure Dave encourages all taxpayers to take advantage of tax laws like the mortgage interest deduction the business expense. Then there is the exemption for gifts and estate taxes. Dave Ramsey is the man.

If you have a giant estate that easily tops the 1206 million or 2412 million. Dave Ramsey despises the estate tax. In the earlier example the two 20000 taxable gifts made in 2021 would reduce your estate tax exemption by 10000 to 11690000 11700000- 10000.

Notice that those percentages jump up pretty quickly. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes. Ramseys teaching are centered around what he calls The Seven Baby Steps.

What Is The 2022 Gift Tax Limit Ramseysolutions Com

Spring 2022 Usf Commencement Program By Usf Commencement Issuu

Determine Unreported Gifts The Estate And Gift Tax Is A Unified By Patti Spencer Estategenie Blog

Determine Unreported Gifts The Estate And Gift Tax Is A Unified By Patti Spencer Estategenie Blog

Estate Planning 101 Presentation

Advisor Resources Betterment For Advisors

How Can I Gift Money To Kids Without Being Taxed Youtube

How Can I Gift Money To Kids Without Being Taxed Youtube

The Arkansas Lawyer Winter 2010 By Arkansas Bar Association Issuu

White Bear Press By Press Publications Issuu

Death Tax The Truth About Estate Taxes Ramseysolutions Com

International Philanthropy Southwest

To Halve Or Halve Not The Federal Estate Tax Exemption Drops In Half In 2026 And Maybe In 2021 Articles

Estate Planning 101 Presentation

How Can I Gift Money To Kids Without Being Taxed Youtube